Tungsten Prices Surge in 2026: What It Means for Your Operation

Tungsten pricing has increased more than

Global supply constraints, export controls, and rising demand across defense, aerospace, and advanced manufacturing have pushed tungsten pricing to record levels. With limited supply and continued demand, market conditions are expected to remain tight.

For welding operations, this means higher electrode costs, tighter availability, and increased pressure to improve efficiency.

Why Tungsten Prices Are Increasing

Export Controls and Limited Supply

China accounts for the majority of global tungsten production and has implemented strict export controls and reduced mining quotas. These actions have significantly reduced available supply outside China.

At the same time, tungsten production outside China remains fragmented, limiting the market’s ability to offset these reductions.

Rising Demand Across Critical Industries

Demand for tungsten continues to grow across industries where performance and durability are critical:

- Defense and aerospace

- Energy and industrial manufacturing

- Electric vehicles and battery technology

- Semiconductors and electronics

Tungsten’s unique properties make it difficult to replace, sustaining demand even as prices increase.

Inventory Depletion and Market Tightness

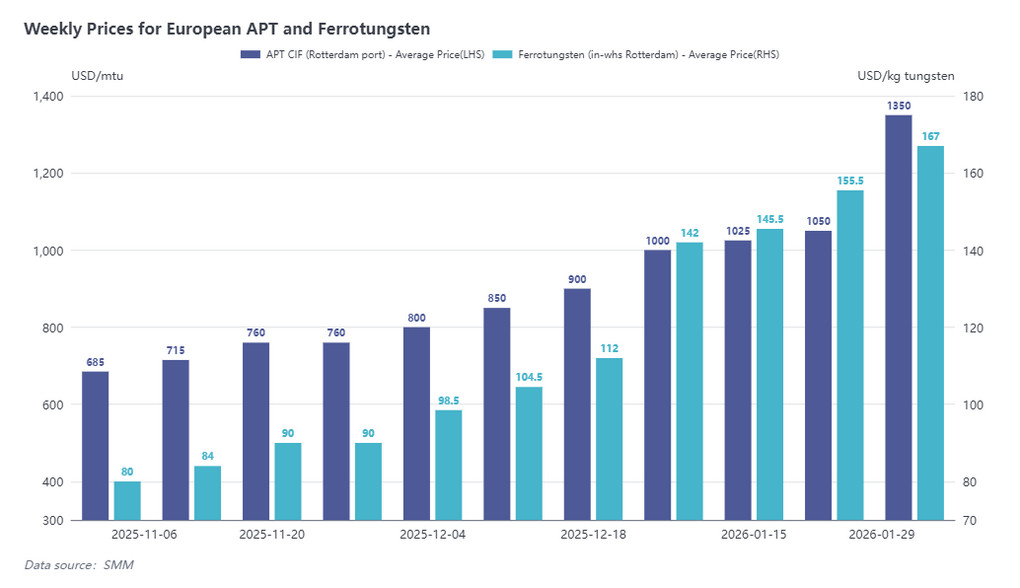

Global inventories are tightening. According to SMM analysis, low inventory levels and concentrated purchasing have accelerated price increases across European and global markets.

This imbalance between supply and demand is expected to continue.

Record Pricing Across the Tungsten Market

Ammonium Paratungstate (APT), the primary raw material used in tungsten production, has reached record pricing levels in 2026. Market data shows pricing exceeding $1,300 per metric tonne unit in key markets.

These increases are being driven by limited supply, rising demand, and tightening inventories across the global supply chain.

What This Means for Welding Operations

Increased Electrode Costs

Reduced Availability

Higher Cost per Weld

How to Control Tungsten Costs in 2026

Use Precision Tungsten Grinders

Switch to Pre-Ground Tungsten

Pre-ground electrodes eliminate manual grinding and deliver consistent performance. This reduces labor time and improves weld quality.

DGP specializes in pre-ground electrodes manufactured to strict tolerances for maximum productivity.

Reduce Cost Per Weld

Every inch of tungsten matters. Inefficient grinding, inconsistent preparation, and discarded electrodes all increase cost per weld.

By standardizing tungsten preparation and maximizing usable electrode length, operations can significantly reduce material consumption and improve productivity.

The Outlook for 2026 and Beyond

Current market conditions suggest that tungsten pricing will remain elevated. Export restrictions, limited new supply, and continued global demand are expected to sustain upward pressure on pricing.

While new mining projects are underway, they will take time to impact supply. For now, operational efficiency remains the most effective way to manage cost.

Take Control of Your Tungsten Costs

Tungsten prices have changed. The way it is used in your operation should as well.

Improving grinding practices, reducing waste, and optimizing electrode usage can protect margins and maintain productivity in a high-cost environment.